Mispriced Optionality (Part 2 of 2)

Looking at strategic ways to play pre-deal SPAC warrants while reducing risk

If many pre-deal SPAC warrants are truly underpriced (as I currently believe), why does this opportunity exist? I think there are four main factors driving the mispricing:

Pessimism surrounding SPACs ability to get deals done

Pessimism around how deSPAC share prices will perform

End of year tax loss selling driving prices down

Low liquidity which keeps sophisticated arbs / quants / hedge funds from being interested and/or able to trade warrants in size

Let’s address #3 and #4 first. Tax loss selling is a temporary phenomenon which tends to reverse itself with time. Other investors’ losses from buying too high during periods of SPAC frenzy can benefit opportunistic investors who swoop in when sentiment is terrible. One of my favorite investing mantras is “buy fear & sell greed” because everyone knows it but few are able to actually do it in practice.

Low liquidity in warrants is both a blessing and a curse for individual investors, since it creates exploitable inefficiency but also makes trading challenging. That being said, I’ve been able to build pretty decent size in some individual warrants utilizing frequent small limit orders. I also diversify across a number of different underlying SPACs, so my overall warrant portfolio is a meaningful “position” within my greater investment portfolio.

Too Much Pessimism?

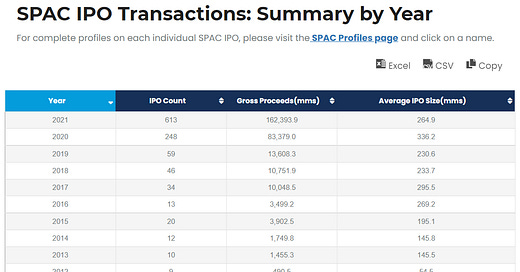

I mentioned in Part 1 that I expect more SPAC liquidations in 2022 and 2023 due to the sheer number of SPACs seeking deals and a more hesitant pool of target companies willing to go public via SPAC transaction. Despite that belief, I still expect many SPACs to announce and complete deals in the next 1-2 years for several reasons:

Venture Capital & Private Equity portfolios are stuffed with highly valued private companies for which they seek exits

SPACs are getting more creative and playing a role in corporate spinoffs

Many SPACs have been quietly working on deals behind the scenes for months (there is a timing/backlog effect)

SPAC sponsors are incentivized to get deals done; they have levers to pull such as paying shareholders to extend deadlines

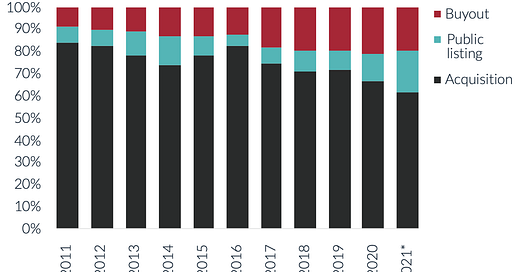

CB Insights keeps a great list of “unicorn” startups with valuations $1 Billion or higher. Today there are 958 companies on that list, and more startups will likely join the list within the next year. Many of these companies will remain private. Some of them will choose to sell to a strategic or financial acquirer. Some of them will go public via the traditional IPO route. And I do believe some of them will go public via SPAC. Although the majority of startup exits tend to be acquisitions, public listings are a common exit for larger successful startups and dominate exit dollar volume:

What benefits does a company get by going public via SPAC versus the traditional IPO? SPACs are often faster and the valuation can be more efficient since it is negotiated by the company rather than left to guesswork by investment bankers who are incentivized to lowball in an IPO. Bill Gurley, one of the most prominent and successful VCs of all time, laid out these arguments well.

Beyond startup unicorns, there are thousands of seasoned companies owned by private equity firms which might be candidates for SPAC deals. Many PE owned companies have significant debt on the balance sheet, making a SPAC transaction intriguing from a de-leveraging standpoint. While not as clean as an outright sale, fresh capital and a public listing provide liquidity options for private equity firms. These firms are starting to embrace this option:

IPOs are cyclical and public markets have shut to new offerings during periods of market turmoil in the past. I could see a scenario where SPACs become a countercyclical provider of capital and exit opportunities.

Even if that is a stretch, SPACs are starting to become a vehicle for corporate spinoffs. Within the past month two spinoff transactions with SPACs have been announced, with Harley Davidson spinning out its electric motorcycle division (Livewire) via $IMPX and Fluor spinning out its small module nuclear reactor division (NuScale) via $SV. Julian Klymochko, a SPAC expert & arbitrageur, predicted this back in March 2021:

The point here is that there’s theoretically still a large supply of potential SPAC targets. Even if the pool is smaller today than it was a year ago, the pool is not zero. SPAC sponsors will adapt, get creative, and extend deadlines if necessary.

SPAC Selection Strategies

Still, an investor doesn’t have to shotgun capital across the entire SPAC warrant universe. My view is that being selective with SPACs plays a big role in reducing risk and maximizing upside.

Some sponsors are already proving their prowess at getting multiple deals done per year (Eagle Equity, dMY, Gores, Churchill, Social Capital, etc). Unfortunately their warrants do not tend to be on the cheap end of the spectrum. What else could one focus on when looking for value priced warrants? Here are some possible criteria:

Sponsor / SPAC executive team background

Professional background (VC / PE? Operator? Industry connections?)

Personal network footprint

Reputation / track record

Size of team

Industry or niche focus

Trust size

Underwriting bank partner

Warrant redemption or related legal terms

Time to deadline

Recent quarterly expenses trend

Rising trading volume

Current warrant price vs all time high price

I choose to focus a lot on SPAC executive backgrounds because ultimately people and relationships are key to getting transactions done in my opinion. Competition for deals can be fierce and sponsors need an edge. That edge could be a large sourcing pool, deep industry connections, expertise that might benefit the target company, ability to drum up excitement with public market investors, resources to do a fast transaction close, etc. Assessing this is tough and subjective. I don’t have precise prescriptions for how it should be done, but here’s how I think about filtering down:

When it comes to SPAC teams with predominantly finance backgrounds, I tend to favor top tier VC or PE backgrounds because they’ll (ideally) have broad networks with connections to many private companies. I personally shy away from sponsors from lesser known firms with low AUM. Hedge fund and public market backgrounds don’t seem as relevant for sourcing deals with private companies, but there are always exceptions to these rules of thumb (Oaktree, Pershing, etc). Celebrities such as pop stars and athletes don’t seem to offer much benefit based on what I’ve seen thus far, and I doubt many of them are spending their time hustling on behalf of a SPAC.

Many SPACs have an initial industry or niche focus, such as healthcare & biotech, tech & software, sports & fitness, media, travel, education, or energy & sustainability. This can be an advantage when the sponsor has deep industry knowledge and connections, particularly if the sponsor built or ran a company in that area. It can also work against the SPAC if the niche is out of favor, the sponsor is not well liked by industry, and/or when a deadline is approaching. Generally I think niche focus is a positive when the sponsor’s background aligns with the niche.

Large trust sizes help on the margin because of the capital they can bring into the target company, possibly even reducing the need for a PIPE. I’m not convinced the initial SPAC underwriters matter all that much in the end, but I’m open to arguments. Most warrant terms tend to be fairly standardized, though redemption terms can vary somewhat. I always check the terms, but rarely do they alter my investing decision.

Time to deadline is an interesting factor to consider. Most SPACs are going to need at least a few months if not longer to get to the finish line on a deal. For SPAC deals announced and completed in 2020 & 2021, the average time from SPAC IPO to deal announcement was roughly nine months. Of course any SPAC nearing their wind-down deadline presents a major risk to the value of the warrants. Therefore downside risk might be mitigated somewhat by avoiding warrants on SPACs which are within 1-3 months of their deadline. There tends to be a “sweet spot” for SPACs that have been trading awhile but not so long that they are very close to their deadline.

Trading volumes and SPAC expense trends (from their quarterly 10-Q filings) can sometimes be a “tell” that a deal is soon to be announced, but they also give off a lot of false positive signals. Deals do get leaked occasionally, but there are also frequent false rumors (ex: Discord/$IPOF and Northvolt/$CRHC recently). Many arbitrage funds traffic in SPAC shares and warrants, occasionally causing trading volume to spike for purely technical reasons. Meanwhile quarterly expenses can rise due to deal negotiations or due diligence that don’t end up in a definitive merger agreement. How one utilizes these signals probably depends on strategy and time frame, i.e. trading versus investing. They don’t typically drive my own investment decision, but I’ve FOMO’d into a larger position on occasion after seeing expenses and volumes rise.

Modeling Potential Risk & Return

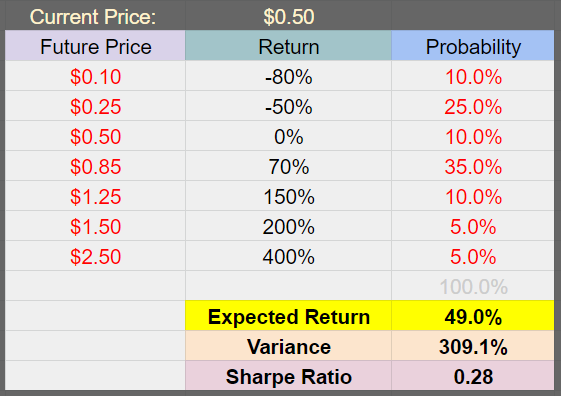

Let’s take a look at some possible scenarios for a single SPAC warrant. I showed earlier in Part 1 that the majority of SPAC warrants trade at or above $1.00 on an initial deal announcement. But how do we think about other outcomes? Below is a hypothetical set of outcomes and associated probabilities for a SPAC warrant currently priced at $0.50:

Avoiding SPAC warrants which are nearing their deadline might reduce the chance of a total loss (-100%), but I’m not ruling out the possibility of some bad outcome where the SEC restricts most SPACs or a legal challenge thwarts a particular SPAC. Therefore I think it’s reasonable to apply a 10% probability to an outcome of 80% loss from purchase price, even though these are quite rare in recent history. I also think it’s reasonable to apply meaningful probability to a negative outcome (-50%) due to SPAC warrants trading down on general pessimism and low deal announcements and/or the situation where exiting a warrant at a loss is prudent as its deadline approaches. Those deeply negative scenarios make up about one-third of my overall probability table.

In the table above I also assume some probability of a breakeven outcome, where one exits the position for zero gain/loss due to a deal announcement that the market really dislikes. Roughly a third of total probability is then applied to the scenario where a deal announcement or stronger SPAC market generally causes a warrant to trade up to the $0.85 level. This is well below the level of the median post-deal warrant in 2021, and more in line with the worst month of 2021. I also apply about 20% of the total probability to some positive right-tail outcomes for those SPAC deals that the market gets excited about. I do not assume any wild DWAC/LCID/CHPT style outliers. Nonetheless, the mean expected return is almost 50% under these scenarios. Variance is quite high and the Sharpe ratio is not awesome, but these can be improved by combining different warrants in a warrant portfolio and also by combining the warrant portfolio itself with other non-correlated assets within a larger portfolio. These warrants are “event driven”, so they can be uncorrelated with the broader stock market, which is a very valuable characteristic.

The price paid for a warrant does affect potential returns quite a bit. If we assume the same outcomes and probabilities as before, but a 30% higher initial price for the warrant, the expected return drops significantly to just 15%:

I must point out that higher quality SPACs often have higher priced warrants and higher quality SPACs probably have different probabilities of upside versus downside. If you want to play around with different return scenarios & probabilities, check out the “Single Warrant Analysis” tab in my SPAC Warrant data spreadsheet (just make sure total probability sums to 100%!). Here’s an example of a higher priced warrant where the probabilities shift more in favor of positive outcomes:

Summary Thoughts

Sentiment around SPACs is currently terrible, which has driven most pre-deal warrants down to fresh lows. I think the current setup and potential returns are compelling, especially as we head into a stronger seasonal period for both trading and deal announcements. Diversifying exposure across a subset of strong SPAC teams and avoiding SPACs with approaching deadlines could help lower downside risk.

Further Resources

Some of you may ask which specific SPAC warrants I currently own. Because warrants tend to be illiquid and I want to avoid giving specific investment advice, I think it’s best that I avoid presenting the full list here. I will say however that I’m currently diversified across roughly 30 different pre-deal SPAC warrants. You can probably figure out some of the ones I own from the criteria I discussed earlier. I really like combining criteria such as reputable sponsor with strong VC/PE/exec networks, niche or geographic focus, trust size above $200 million, sweet spot until deadline, low warrant price, etc. For example: one of my first big wins in pre-deal SPAC warrants was with RedBall Acquisition Corp ($RBAC) in October 2021. The executive team included heads of a large private equity firm focused on sports, trust size was $500+ million, the SPAC was just over a year into its two year life, and the warrants traded as low as $0.70 in early fall. After its deal with SeatGeek was announced in October, the warrants traded as high as $1.90 over the following month. I nearly doubled up my capital on that particular position…not bad!

Spactrack.io is a really useful starting point for finding potential warrant ideas in my opinion (I have no ties to them, I’m just a fan). I occasionally post about warrants & SPACs on my Twitter account. I also maintain a Twitter List of SPAC focused accounts which I find helpful in tracking what is happening across the SPAC universe. Many of those accounts also discuss and share their trade ideas. I’m hoping to be more active in Twitter discussions myself going forward.

Lastly, I do discuss specific SPAC teams, warrants, and ideas in our private Discord / subscription community at Skill Incubator. There I cover stocks with weekly market updates, potential trade ideas, fundamental analysis, livestreams, and more. My business partners also cover crypto and personal finance. If that’s something of interest to you, feel free to check it out.

As always, if you have any follow up thoughts or questions on SPAC warrants, let me know in the comments! Cheers 🍻